Social Security benefits to rise 1.5% after inflation adjustment

- Share via

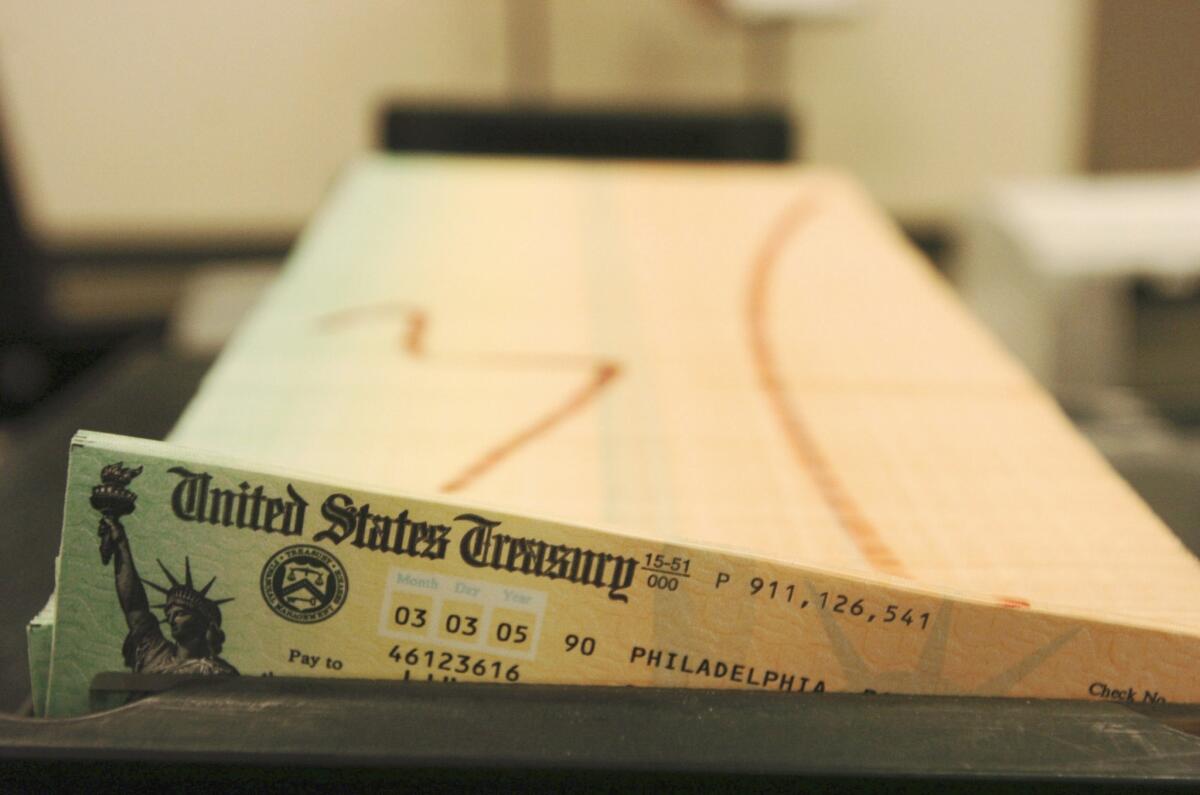

Monthly Social Security payments will rise 1.5% next year, bringing the average benefit amount to about $1,288 after an annual cost-of-living adjustment, the Social Security Administration announced Wednesday.

The 1.5% rise is the smallest increase since 2002 and is down from the 1.7% adjustment in 2012.

The annual cost-of-living adjustment is based on a consumer price index for urban wage earners and clerical workers. Inflation has remained low in recent years, underscored by the latest government data which showed that inflation in September was up just 1.2% from the year before.

Photos: Richest and poorest cities in America

That’s the smallest increase since April, according to the Bureau of Labor Statistics.

As my colleague Don Lee reported Wednesday: “The monthly gain in overall consumer prices was in line with analysts’ expectations and came because of a rebound in gas prices. But stripping out the volatile energy and food components, the so-called core consumer price index ticked up just 0.1% for the second straight month. And on a 12-month basis, this reading of core inflation was up 1.7%, down from 1.8% in August.

By this measure, inflation remains well below the Fed’s 2% target and 2.5% threshold for tightening policy, allowing officials to maintain a stronger focus on lowering unemployment than its other mandate of controlling prices.

The new cost-of-living adjustments will take effect in January, the Social Security Administration said. In 2013, almost 58 million U.S. residents will receive about $816 billion in Social Security benefits.

ALSO:

Some dollar-menu items are passing the buck

Home price gains ease in most large U.S. markets

Subdued inflation gives Fed more reason to maintain stimulus

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.